John M. Chase/iStock Unreleased through Getty Photos

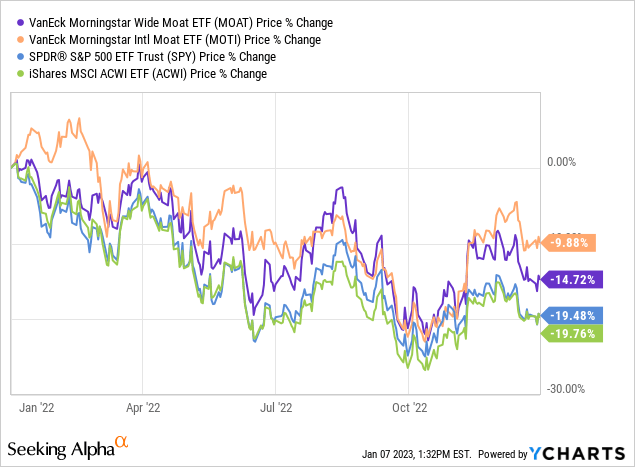

The VanEck Morningstar Extensive Moat ETF (BATS:MOAT) is a semi-passive fund that rebalances its holdings on a quarterly foundation (in truth, twice a 12 months for every of its two sub-portfolios). Earlier than we focus on the most recent quarterly reconstitution, let’s examine how MOAT fared through the powerful 12 months 2022. Whereas the ETF couldn’t keep away from a yearly loss within the double digits, it held up nicely in opposition to the broader market – outperforming the S&P 500 by about 5 share factors:

Let’s additionally point out the efficiency of the VanEck Morningstar Worldwide Moat ETF (MOTI), MOAT’s counterpart for worldwide shares, which misplaced solely 10% regardless of the turmoil in world markets. It seems just like the “moat-investing” technique, that’s, the concentrate on shares which can be thought of to own lasting aggressive benefits, did moderately nicely in 2022.

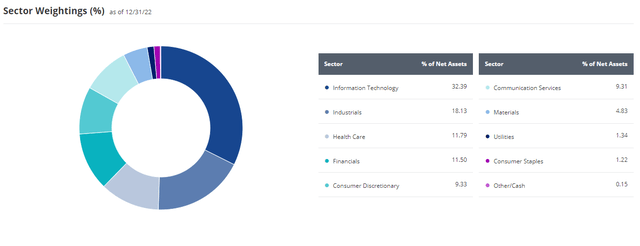

MOAT began 2023 with its holdings largely unchanged from This autumn 2022, with only a few strikes on the December reconstitution (extra on this beneath). This leaves the ETF positioned for a possible rebound in tech shares which make up a few third of its holdings. Cyclicals (Industrials, Financials and Shopper Discretionary) additionally represent a large portion of the ETF:

This may in fact minimize each methods in 2023, relying on whether or not we get a recession, and the way arduous it hits. Nevertheless, I’d argue that short-term anticipations will not be the precise perspective for these focused on MOAT. Moat investing is all in regards to the conviction that firms that get pleasure from sturdy aggressive benefits will ship superior returns over the long term. The MOAT ETF, due to this fact, is finest fitted to traders with a long-term horizon.

What’s extra, MOAT will also be of worth to stock-pickers, who could not purchase the ETF however can nonetheless achieve from periodically reviewing its holdings. This fashion, one can view a inventory’s inclusion in MOAT as a vote of confidence. For instance, I added to Medtronic (MDT) and constructed a place in State Avenue (STT) throughout This autumn ’22, two shares whose presence in MOAT confirmed my very own due diligence.

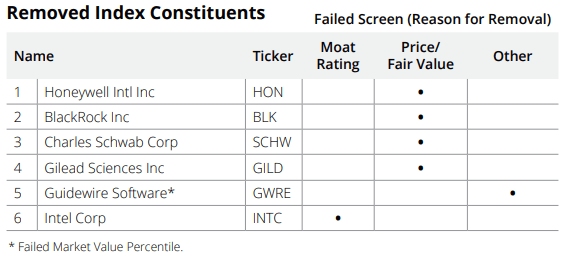

As I discussed earlier, there have been restricted adjustments through the reconstitution in December 2022. Nonetheless, the removing of Intel (INTC) was important, because it was primarily based on a perceived weakening of the corporate’s financial moat (from “broad” to “slender”). Different eliminated blue chips included BlackRock (BLK) and Honeywell (HON). Coming the opposite approach have been the likes of Dominion Power (D), Fortinet (FTNT) and some others that Morningstar considers to be buying and selling at enticing valuations.

The MOAT ETF: An Overview

Observe: Traders already accustomed to the MOAT ETF and Morningstar’s methodology could need to skip this half and transfer on to the December rebalance part.

The best way the MOAT ETF works was nicely summarized by fellow contributor George Fisher in an earlier article:

[MOAT] owns 40 to 50 shares with broad moats and which can be buying and selling at a reduction to honest worth, normally within the 15% to 25% low cost vary. When moat rankings change or the low cost to honest worth turns into comparatively noncompetitive with others, the place is changed. Not solely do the elements change primarily based on moat score and low cost to honest worth, however the portfolio is re-balanced to an equal weighting as nicely. This creates a comparatively excessive annual portfolio turnover of round 25%.

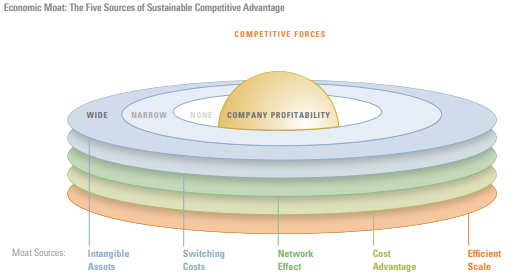

The ETF, managed by VanEck, is predicated on the Morningstar® Extensive Moat Focus Index, which incorporates solely U.S. shares and, because the title suggests, solely firms that possess broad financial moats. However what precisely does Morningstar imply by “financial moat”? As per VanEck:

Financial Moat rankings symbolize the sustainability of an organization’s aggressive benefit. Extensive and slender moat rankings symbolize Morningstar’s perception that an organization could preserve its benefit for a minimum of 20 years and a minimum of 10 years, respectively. An financial moat score of none signifies that an organization has both no benefit or an unsustainable one. Quantitative elements used to determine aggressive benefits embody returns on invested capital relative to value of capital, whereas qualitative elements used to determine aggressive benefits embody buyer switching value, value benefits, intangible property, community results, and environment friendly scale.

Morningstar This technique has enabled MOAT to outperform the S&P 500 since its inception in 2012. With this in thoughts, allow us to now focus on the most recent strikes as a part of the latest December reconstitution.

December Rebalance: The Eliminated Constituents

The latest mid-December reconstitution – affecting the sub-portfolio whose earlier rebalancing occurred in June – noticed the removing of 6 shares:

VanEck

(see VanEck’s full doc right here)

It is uncommon for a inventory to be eliminated as a result of a downgrade of its financial moat score – normally, the strikes are made on valuation grounds – however that is what occurred to Intel. The corporate was downgraded by Morningstar from wide-moat to narrow-moat, ending its presence within the ETF (MOAT, opposite to MOTI, contains solely wide-moat shares). The main microprocessor producer is taken into account by Morningstar’s analysts to face plenty of headwinds, with elevated aggressive stress leading to decrease margins throughout its actions, and an anticipated lack of market share within the knowledge heart section. Particularly, Morningstar fears the competitors of AMD’s (AMD) newest EPYC “Genoa” processors, and prefers wide-moat NVIDIA (NVDA) – which stays a MOAT constituent.

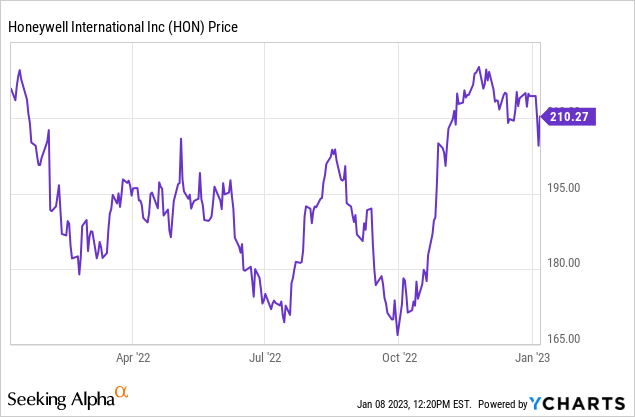

One other notable removing is Honeywell, this time on valuation grounds, regardless of a really optimistic evaluation by Morningstar on the subject of the agency’s aggressive place:

Honeywell is among the strongest multi-industry companies in operation as we speak. We expect the agency has efficiently pivoted to seize a number of ESG developments, together with the necessity to drive power effectivity, cut back emissions, and e-commerce, amongst others. […] Over the following 5 years, we predict Honeywell is able to mid-single-digit top-line development, incremental working margins within the mid-30s, low-double-digit adjusted earnings per share development, and free money circulate margins within the midteens.

Supply: Morningstar

The inventory merely turned too expensive by way of low cost to honest worth (in comparison with different MOAT holdings) following its run-up within the fourth quarter:

The identical goes for financials BlackRock and Charles Schwab (SCHW), which MOAT added as lately as Q1 ’22, however trimmed at year-end on valuation grounds. Gilead (GILD) and Guidewire Software program (GWRE) are the opposite “victims” of the December reconstitution.

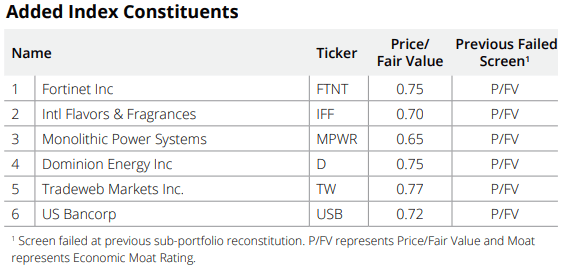

December Rebalance: The New Entrants

The 6 names eliminated gave method to one other 6 wide-moat firms:

VanEck

This short-list contains shares that have been buying and selling (on the time of their choice, i.e. early December) at reductions starting from 35% for Monolithic Energy Programs (MPWR) to 23% within the case of Tradeweb Markets (TW). One of many notable inclusions is utility Dominion Power (D), for which Morningstar presently has a $78/share honest worth estimate, even when they don’t anticipate a near-term re-rating – as a result of an absence of catalysts. The inventory had a tough fourth quarter, with traders unnerved by the uncertainties surrounding the corporate’s strategic enterprise evaluation. This has made its valuation enticing in Morningstar’s view, for affected person traders.

Let me spotlight the inclusion of cybersecurity firm Fortinet (FTNT), with a $68/share honest worth estimate. This confirms MOAT’s urge for food for tech – Morningstar sometimes finds sturdy aggressive benefits corresponding to community results in these shares. It is value noting that Alphabet, Microsoft, Amazon and Meta are all a part of the ETF, which signifies that they not solely possess a large moat, in addition they commerce at a big low cost to honest worth (see beneath) – in line with Morningstar clearly.

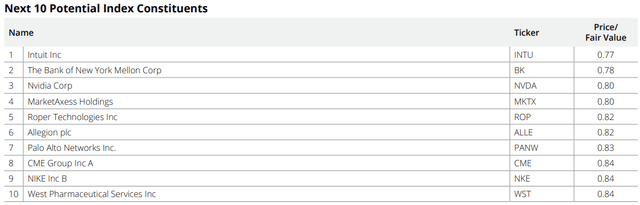

These Ready On The Sidelines

As at all times, VanEck offers a listing of shares that may very well be included as a part of the following rebalance, ought to their valuations warrant it on the time. Numerous industries are represented within the present choice:

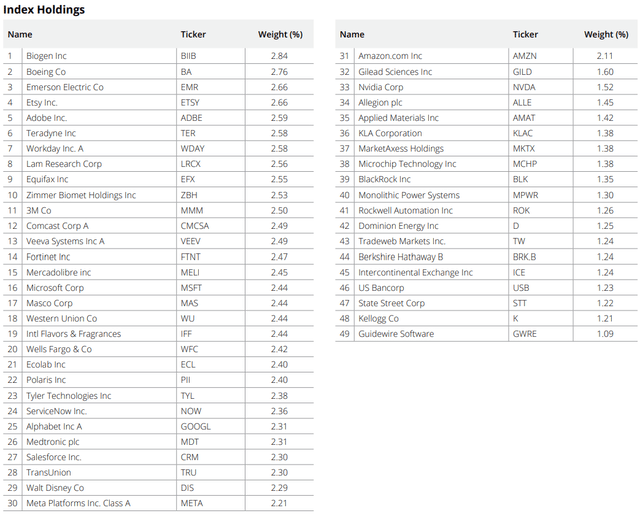

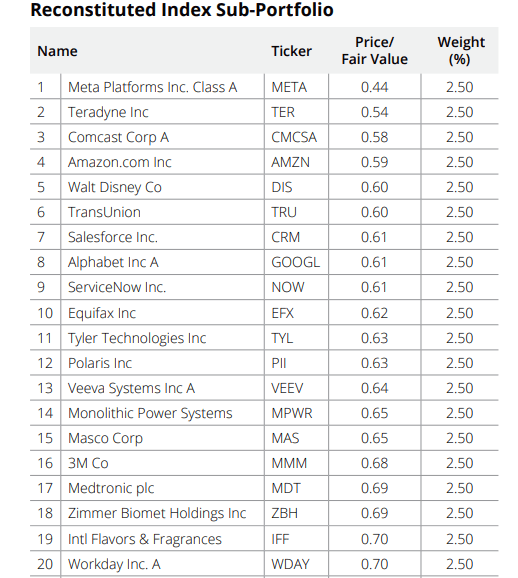

VanEck Under is the complete listing of 49 names included within the MOAT ETF at this cut-off date: VanEck

The listing can be utilized as a supply of concepts for traders in search of wide-moat shares buying and selling at cheap valuations. On this respect, the Value/Honest Worth ratio (as of mid-December) is a useful metric, and the reductions for Large Tech have been seen to be sizable:

VanEck

(see this doc for full element)

Takeaway

The MOAT ETF posted a good efficiency in 2022 in comparison with the broader market. Morningstar has saved a constant methodology and noticed little cause to reshuffle the ETF’s holdings forward of 2023, with only a few adjustments made through the latest December reconstitution.