Key Insights

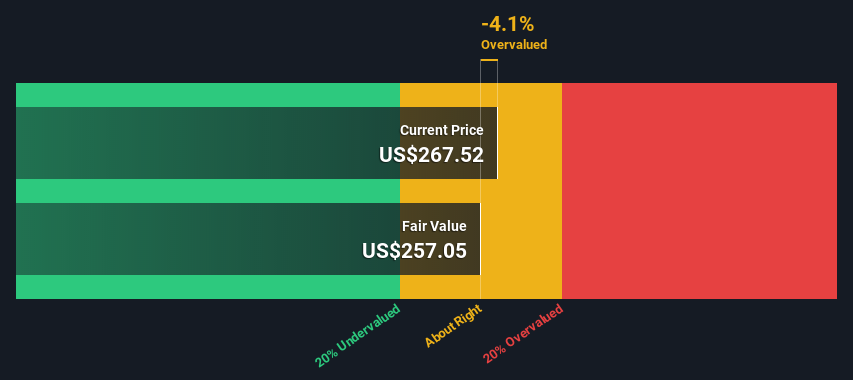

- Rockwell Automation’s estimated honest worth is US$257 primarily based on 2 Stage Free Money Circulate to Fairness

- Present share value of US$268 suggests Rockwell Automation is buying and selling near its honest worth

- Analyst value goal for ROK is US$254 which is 1.1% beneath our honest worth estimate

How far off is Rockwell Automation, Inc. (NYSE:ROK) from its intrinsic worth? Utilizing the newest monetary information, we’ll check out whether or not the inventory is pretty priced by taking the forecast future money flows of the corporate and discounting them again to immediately’s worth. The Discounted Money Circulate (DCF) mannequin is the device we are going to apply to do that. Imagine it or not, it is not too tough to observe, as you may see from our instance!

Bear in mind although, that there are various methods to estimate an organization’s worth, and a DCF is only one methodology. In case you nonetheless have some burning questions on this kind of valuation, check out the Merely Wall St evaluation mannequin.

Try our newest evaluation for Rockwell Automation

The Technique

We’re utilizing the 2-stage development mannequin, which merely means we soak up account two phases of firm’s development. Within the preliminary interval the corporate might have the next development price and the second stage is normally assumed to have a secure development price. To start out off with, we have to estimate the subsequent ten years of money flows. The place attainable we use analyst estimates, however when these aren’t accessible we extrapolate the earlier free money stream (FCF) from the final estimate or reported worth. We assume corporations with shrinking free money stream will gradual their price of shrinkage, and that corporations with rising free money stream will see their development price gradual, over this era. We do that to mirror that development tends to gradual extra within the early years than it does in later years.

Typically we assume {that a} greenback immediately is extra helpful than a greenback sooner or later, so we have to low cost the sum of those future money flows to reach at a gift worth estimate:

10-year free money stream (FCF) forecast

| 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | |

| Levered FCF ($, Thousands and thousands) | US$1.18b | US$1.33b | US$1.55b | US$1.67b | US$2.13b | US$2.37b | US$2.57b | US$2.74b | US$2.88b | US$3.00b |

| Development Fee Estimate Supply | Analyst x9 | Analyst x10 | Analyst x4 | Analyst x3 | Analyst x1 | Est @ 11.20% | Est @ 8.43% | Est @ 6.50% | Est @ 5.14% | Est @ 4.19% |

| Current Worth ($, Thousands and thousands) Discounted @ 9.3% | US$1.1k | US$1.1k | US$1.2k | US$1.2k | US$1.4k | US$1.4k | US$1.4k | US$1.3k | US$1.3k | US$1.2k |

(“Est” = FCF development price estimated by Merely Wall St)

Current Worth of 10-year Money Circulate (PVCF) = US$13b

The second stage is also referred to as Terminal Worth, that is the enterprise’s money stream after the primary stage. For numerous causes a really conservative development price is used that can’t exceed that of a rustic’s GDP development. On this case we’ve used the 5-year common of the 10-year authorities bond yield (2.0%) to estimate future development. In the identical manner as with the 10-year ‘development’ interval, we low cost future money flows to immediately’s worth, utilizing a value of fairness of 9.3%.

Terminal Worth (TV)= FCF2032 × (1 + g) ÷ (r – g) = US$3.0b× (1 + 2.0%) ÷ (9.3%– 2.0%) = US$41b

Current Worth of Terminal Worth (PVTV)= TV / (1 + r)10= US$41b÷ ( 1 + 9.3%)10= US$17b

The whole worth is the sum of money flows for the subsequent ten years plus the discounted terminal worth, which leads to the Complete Fairness Worth, which on this case is US$29b. The final step is to then divide the fairness worth by the variety of shares excellent. In comparison with the present share value of US$268, the corporate seems round honest worth on the time of writing. Bear in mind although, that that is simply an approximate valuation, and like every complicated components – rubbish in, rubbish out.

The Assumptions

We might level out that a very powerful inputs to a reduced money stream are the low cost price and naturally the precise money flows. A part of investing is arising with your individual analysis of an organization’s future efficiency, so attempt the calculation your self and verify your individual assumptions. The DCF additionally doesn’t contemplate the attainable cyclicality of an trade, or an organization’s future capital necessities, so it doesn’t give a full image of an organization’s potential efficiency. Provided that we’re taking a look at Rockwell Automation as potential shareholders, the price of fairness is used because the low cost price, quite than the price of capital (or weighted common value of capital, WACC) which accounts for debt. On this calculation we have used 9.3%, which is predicated on a levered beta of 1.225. Beta is a measure of a inventory’s volatility, in comparison with the market as a complete. We get our beta from the trade common beta of worldwide comparable corporations, with an imposed restrict between 0.8 and a couple of.0, which is an inexpensive vary for a secure enterprise.

SWOT Evaluation for Rockwell Automation

- Debt is effectively lined by earnings and cashflows.

- Dividends are lined by earnings and money flows.

- Earnings declined over the previous 12 months.

- Dividend is low in comparison with the highest 25% of dividend payers within the Electrical market.

- Costly primarily based on P/E ratio and estimated honest worth.

- Annual earnings are forecast to develop for the subsequent 3 years.

- Annual earnings are forecast to develop slower than the American market.

Wanting Forward:

While necessary, the DCF calculation is just one of many elements that you have to assess for a corporation. It is not attainable to acquire a foolproof valuation with a DCF mannequin. Ideally you’d apply totally different instances and assumptions and see how they’d impression the corporate’s valuation. If an organization grows at a unique price, or if its value of fairness or danger free price adjustments sharply, the output can look very totally different. For Rockwell Automation, there are three extra gadgets it is best to have a look at:

- Dangers: For example, we have discovered 2 warning indicators for Rockwell Automation that you have to contemplate earlier than investing right here.

- Future Earnings: How does ROK’s development price examine to its friends and the broader market? Dig deeper into the analyst consensus quantity for the upcoming years by interacting with our free analyst development expectation chart.

- Different Excessive High quality Alternate options: Do you want a superb all-rounder? Discover our interactive listing of top quality shares to get an thought of what else is on the market you could be lacking!

PS. The Merely Wall St app conducts a reduced money stream valuation for each inventory on the NYSE day by day. If you wish to discover the calculation for different shares simply search right here.

Valuation is complicated, however we’re serving to make it easy.

Discover out whether or not Rockwell Automation is probably over or undervalued by trying out our complete evaluation, which incorporates honest worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

Have suggestions on this text? Involved in regards to the content material? Get in contact with us instantly. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We goal to carry you long-term centered evaluation pushed by basic information. Be aware that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.